Real-Time Fraud Prevention for Financial Institutions

Trusted by financial institutions worldwide

Our platform processes millions of transactions daily, preventing fraud before it impacts your customers.

- Transactions Processed

- 2.4B+

- Fraud Prevented

- $850M+

- Detection Speed

- <50ms

- False Positive Rate

- 0.03%

Method

Threat intelligence from the other side

Mindwise operates as a comprehensive monitoring platform, providing financial institutions with real-time threat intelligence and proactive fraud prevention capabilities across global markets.

Monitor

Comprehensive surveillance of global underground marketplaces, dark web forums, and threat actor communications to identify emerging risks.

- Dark web monitoring

- Underground marketplaces

- Threat actor tracking

Analyze

Advanced threat intelligence analysis correlating compromised financial data with specific institutions and customer portfolios.

- Data correlation

- Portfolio matching

- Risk assessment

Protect

Real-time notifications and detailed intelligence reports delivered to financial institutions when their assets are exposed with proactive remediation guidance.

- Real-time alerts

- Intelligence reports

- Proactive guidance

- Global Coverage

- 24/7

- Threat Sources

- 1000+

- Average Alert Time

- <1hr

- Platform Uptime

- 99.9%

Services

Comprehensive fraud prevention solutions

Our platform provides end-to-end protection across all aspects of financial security and fraud prevention.

Fraud Prevention

Real-time transaction monitoring and fraud detection across all payment channels. Prevent card fraud, account takeover, and unauthorized transactions.

- Real-time transaction monitoring

- Card-not-present fraud detection

- Account takeover prevention

- Payment gateway protection

Identity Protection

Comprehensive identity verification and protection services that outperform traditional competitors with proactive monitoring and instant alerts.

- Identity theft monitoring

- Synthetic identity detection

- Credit monitoring

- Dark web surveillance

Threat Intelligence

Advanced threat intelligence feeds and machine learning algorithms that identify emerging fraud patterns and adapt to new attack vectors automatically.

- Global threat intelligence feeds

- Machine learning detection

- Pattern recognition

- Predictive analytics

Compliance Solutions

Automated compliance with regulatory requirements including AML, KYC, and PCI-DSS standards with real-time reporting and audit trails.

- AML/KYC automation

- PCI-DSS compliance

- Real-time reporting

- Audit trail management

Risk Assessment

Comprehensive risk analysis and vulnerability assessments to identify potential security gaps before they can be exploited by malicious actors.

- Vulnerability scanning

- Penetration testing

- Risk scoring

- Remediation planning

Incident Response

24/7 incident response services with rapid containment, investigation, and recovery to minimize business impact and restore normal operations.

- 24/7 emergency response

- Forensic investigation

- Damage containment

- Recovery planning

What Makes Us Different

Prevention-first cybersecurity

While others react to threats, we prevent them. Our proactive approach stops fraud before it starts.

Proactive Threat Detection vs. Reactive Reporting

Uncover risks before they become breaches with our sophisticated monitoring and intelligence-gathering techniques. Stop fraud before it is ever attempted.

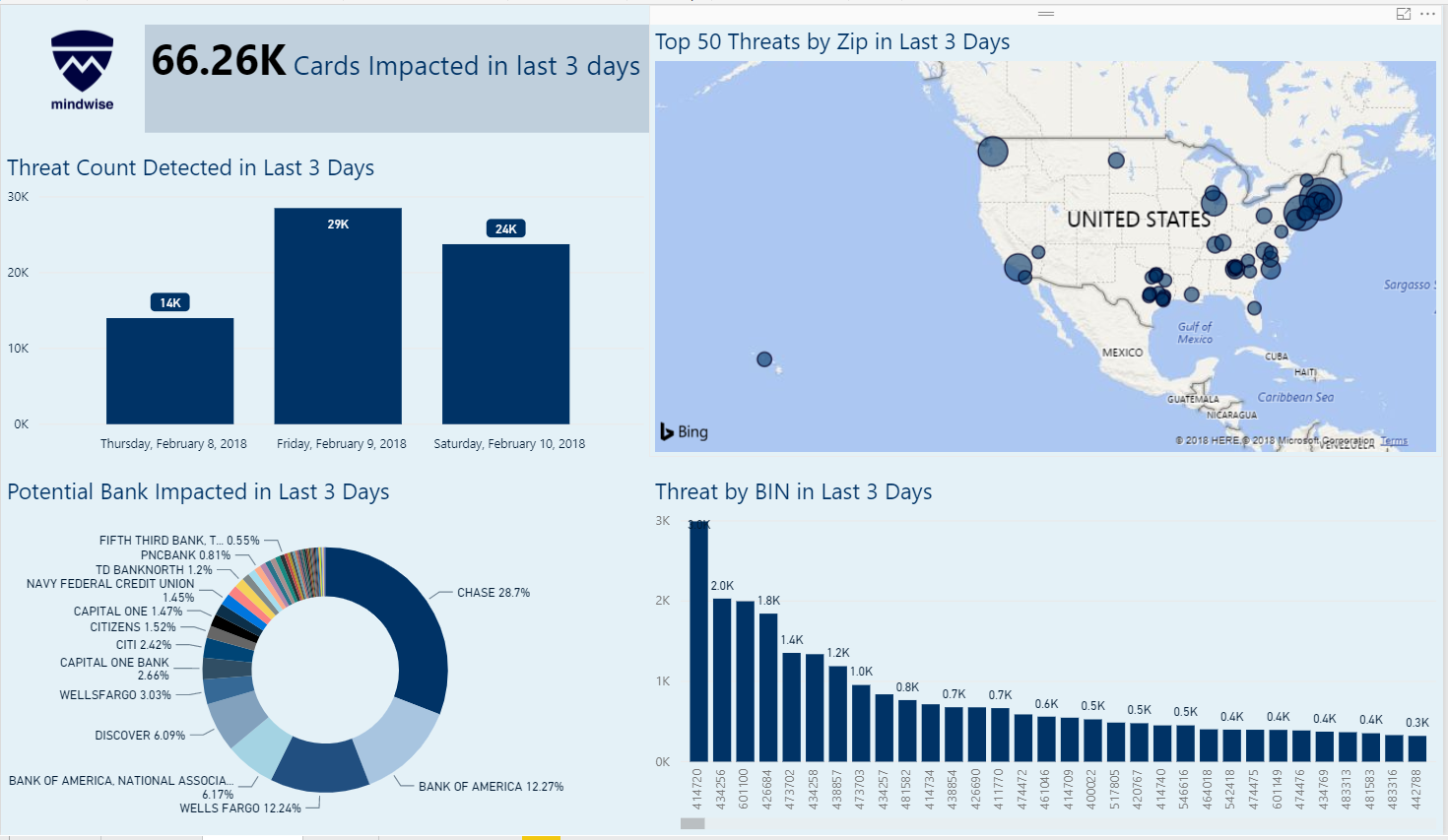

Our threat detection system operates 24/7 across global underground marketplaces, identifying compromised credentials, exposed card data, and emerging attack patterns. By monitoring threat actors in their native environments, we provide actionable intelligence an average of 6-12 months before traditional security vendors.

Swift Incident Resolution

When threats strike, our team delivers immediate containment and remediation to limit damage and restore security.

Our incident response team maintains a sub-60 minute response time for critical threats. With direct relationships to major card networks, financial institutions, and law enforcement, we can freeze compromised accounts, block fraudulent transactions, and coordinate takedowns faster than any competitor.

Prevention-First Strategy

We build robust defenses and proactive processes to stop incidents before they start, not just detect them after the fact.

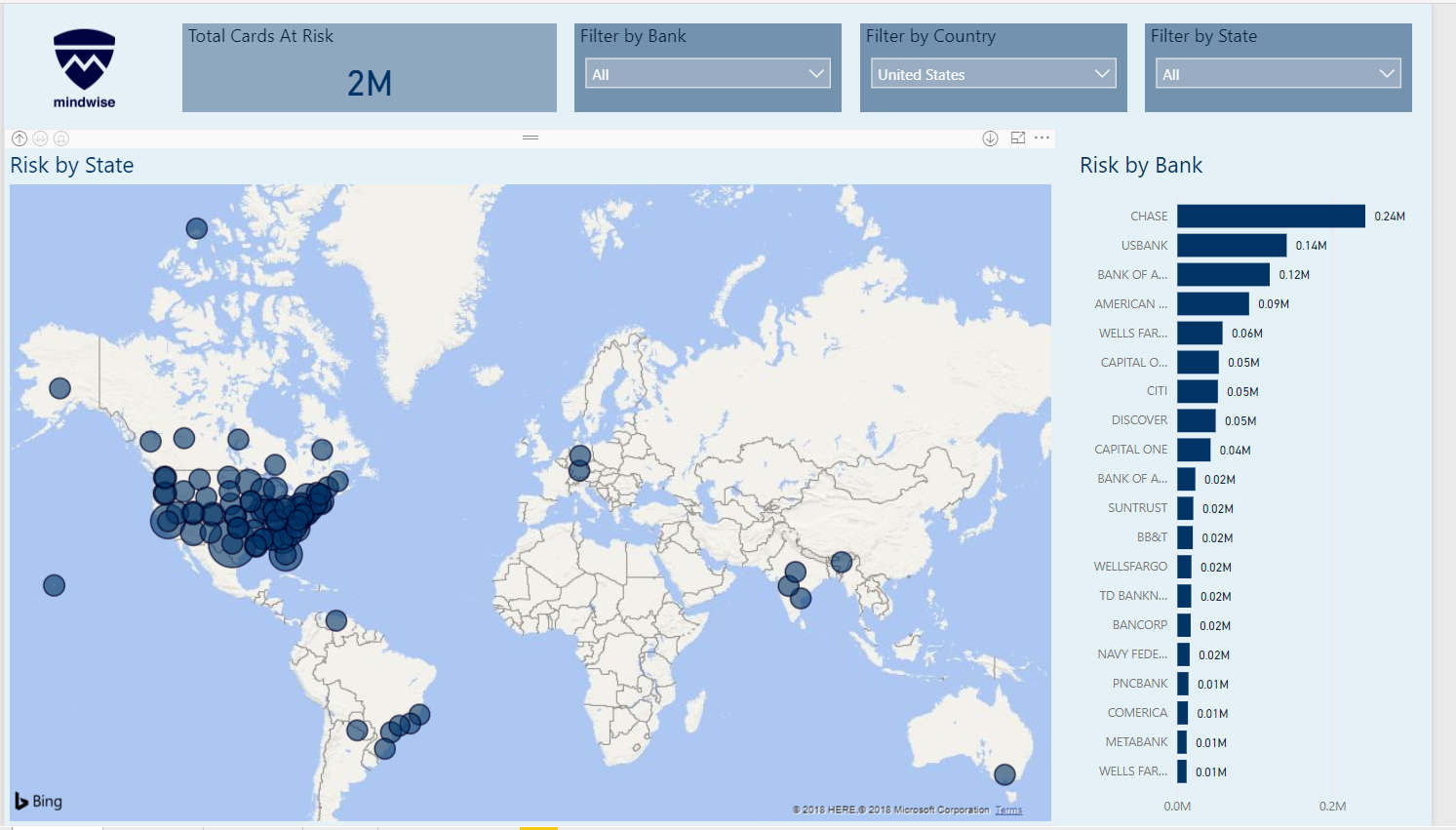

Our prevention framework includes automated threat blocking, real-time BIN monitoring, and predictive risk modeling that identifies vulnerabilities before they're exploited. This approach has helped our clients reduce fraud losses by an average of 73% within the first year.

Comprehensive Security Solutions

From proactive threat hunting to decisive incident response, our tailored services address your unique risk profile—whether you're a global enterprise or an individual facing complex threats.

Our solutions scale from small credit unions to global payment processors, with customizable threat intelligence feeds, API integrations, and dedicated security teams. Every client receives enterprise-grade protection tailored to their specific industry, size, and risk tolerance.

Actionable Intelligence Insights

Stay ahead of adversaries with proactive analysis of emerging risks targeting your industry and assets with our comprehensive Cyber Surveillance and Intelligence Platform.

Our intelligence platform processes millions of data points daily from over 1,000 sources including dark web forums, telegram channels, underground marketplaces, and threat actor communities. Machine learning algorithms identify patterns and correlate threats specific to your organization, delivering actionable insights that prevent attacks before they launch.

Ready to move from reactive security to proactive protection?

Use Cases

Protecting financial institutions of all sizes

From community banks to global payment processors, our platform scales to meet your specific fraud prevention needs.

Banks & Credit Unions

Comprehensive fraud prevention for retail banking, commercial banking, and credit union operations. Protect customer accounts, transactions, and sensitive financial data.

- Account takeover prevention

- Wire fraud detection

- AML/KYC compliance automation

Payment Processors

High-volume transaction processing with real-time fraud detection. Scale to handle millions of transactions while maintaining sub-50ms detection speeds.

- Real-time transaction scoring

- Multi-merchant fraud detection

- API rate limiting & controls

Merchant Gateways

Protect e-commerce transactions and reduce chargebacks. Intelligent fraud prevention that balances security with customer experience for online merchants.

- Card-not-present fraud prevention

- Device fingerprinting

- 3D Secure integration

Consumer Protection

Direct-to-consumer identity protection services that outperform traditional competitors. Proactive protection with comprehensive monitoring and instant alerts.

- Identity theft protection

- Credit monitoring

- Dark web monitoring

Case Studies

Proven results for leading institutions

See how Mindwise has helped organizations across the financial sector and beyond protect their assets and customers.

Golden One Credit Union

Safeguarded members with continuous monitoring and remediation of BIN numbers and credentials, ensuring robust protection.

First National Bank

Empowered executives with monthly intelligence reports on marketplace exposures, driving informed risk management decisions.

USPS Cybercrime Postal Division

Partnered with USPS to pinpoint vendors on illicit marketplaces, delivering actionable intelligence for federal investigations.

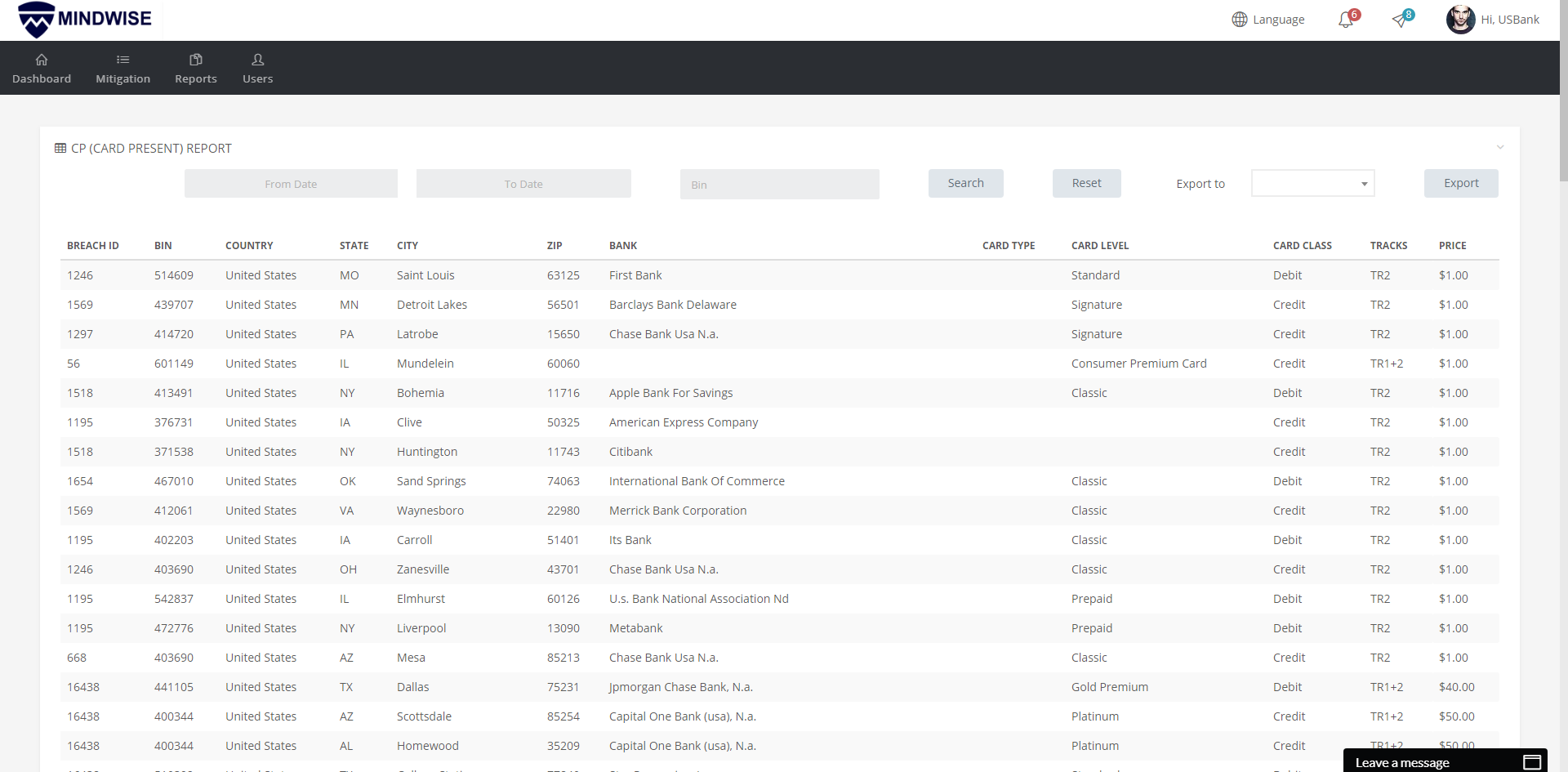

Unparalleled Visibility for Card Issuers

Our platform provides financial institutions with direct, real-time access to compromised card data affecting their portfolios.

Compromised Card Intelligence

Monitor compromised cards affecting your portfolio with detailed BIN analysis and geographic data.

Advanced Filtering & Search

Powerful search and filtering capabilities to quickly identify specific threats and vulnerabilities.

Detailed Card Analysis

Deep dive into individual card details including card level, type, and exposure risk assessment.

Export & Reporting

Comprehensive export functionality and user management for seamless workflow integration.

Ready to protect your business?

Join the growing network of financial institutions using Mindwise to prevent fraud and protect their customers. Schedule a personalized demo to see how our platform can secure your operations.

Email us

Call us

Schedule a demo

Book a personalized demonstration